Gold Dollar Coins Worth Money

Find The Value In Your Dollar Gold Coins

Dec 6th, 2025 ·

1849–1889 gold dollar coins worth money are those in well-preserved condition with low mintage or unique markings. Their value comes from a combination of gold content, historical significance, and rarity, with certified or high-grade examples often commanding substantial premiums above intrinsic metal value.

Gold dollar coins have long captured the interest of collectors and investors, combining historical significance, intricate design, and genuine gold content.

Minted between 1849 and 1889, these small coins reflect pivotal moments in U.S. history, from the California Gold Rush to the growth of branch mints.

Which gold dollar coins are worth money? While most modern “golden” dollars hold only face value, well-preserved historic issues, rare mintmarks, and low-mintage examples of gold coins minted between 1849 and 1889 can be surprisingly valuable.

Understanding what makes gold dollar coins desirable and how to accurately assess their worth is essential for both novice and experienced collectors.

If you’re curious about the value of your coin collection or think you are ready to sell gold coins, trust Coinfully for free, expert appraisals, full transparency, competitive offers, and fast payment.

Table of Contents

History of the One Dollar Gold Coin

Authorized by the Coinage Act of 1849, the gold one dollar coin was the smallest denomination ever struck in gold by the U.S. Mint. Created during the California Gold Rush to utilize the influx of bullion, these coins were minted and circulated for 40 years until production ceased in 1889.

Though small in size, these coins held significant economic and historical importance, reflecting the nation’s westward expansion, evolving artistry, and technical challenges of minting high-value coins in such a tiny format.

Three Design Types for the American Dollar Gold Coin

The U.S. Mint produced three distinct design types for the gold dollar coin, each struck from .900 fine gold and measuring only 13 to 15 millimeters in diameter, depending on the type.

The obverse designs feature either Liberty or the Indian Princess head, encircled by the inscription “United States of America.”

The reverse features a simple wreath surrounding the denomination “1 DOLLAR” and the date as part of a clean, elegant layout reflecting the minimalist artistry of mid-19th-century U.S. coin design.

- Type 1: Liberty Head Coronet (1849-1854): Featured a classical Liberty head wearing a coronet inscribed with the word “Liberty.” This early version was the smallest U.S. coin ever made (13 mm) and proved impractical to handle, which prompted redesign.

- Type 2: Indian Princess Small Head (1854-1856): Enlarged to 15 mm with a thinner planchet to improve usability. The new design depicted a Native American princess, symbolizing America’s growing cultural identity, but weak strikes led to poor detail.

- Type 3: Indian Princess Large Head (1856-1889): The final revision increased Liberty’s head size and improved striking detail. It remained in production until the denomination was retired and became a favorite among collectors for its refined artistry and balanced proportions.

How Much Is a Gold Dollar Coin Worth?

Are gold dollar coins worth money? Yes, indeed! Some can even be worth staggering sums.

The value of a gold dollar coin minted 1849–1889 begins with its gold content, which is approximately 0.04838 troy ounces of pure gold per coin (1.672 g at .900 fineness).

Beyond this melt value, collector demand, coin grade, mintmark, and rarity heavily influence the price. Coins with historical significance, with limited mintage, or in pristine condition, especially those certified by PCGS or NGC, can command values far above their intrinsic gold worth.

What Gives a One Dollar Gold Coin Value?

Gold dollar coins are prized not only for their gold content but also for their numismatic significance.

Factors such as rarity, historical context, and collectible appeal combine with intrinsic metal value, creating a market where certain issues can be worth hundreds or even thousands of dollars to collectors and investors.

Gold One Dollar Coin Metal Composition

Each 1849–1889 gold dollar coin was struck from 90% gold and 10% copper, which created a durable coin which retains intrinsic value today. The total weight is 1.672 grams, containing 0.04838 troy ounces of pure gold.

This small size made the coins challenging to handle in circulation, but their gold content establishes a clear baseline melt value.

Numismatic Value in Gold Dollar Coins

Beyond gold content, numismatic value drives much of a gold dollar’s market price. Factors include mintage figures, mintmarks, historical context, and condition or grade as certified by PCGS or NGC.

Rare issues, coins in pristine condition, or examples with unique errors or low production runs can have significant value among collectors. The combination of historical significance and scarcity often elevates coins far above their intrinsic metal worth.

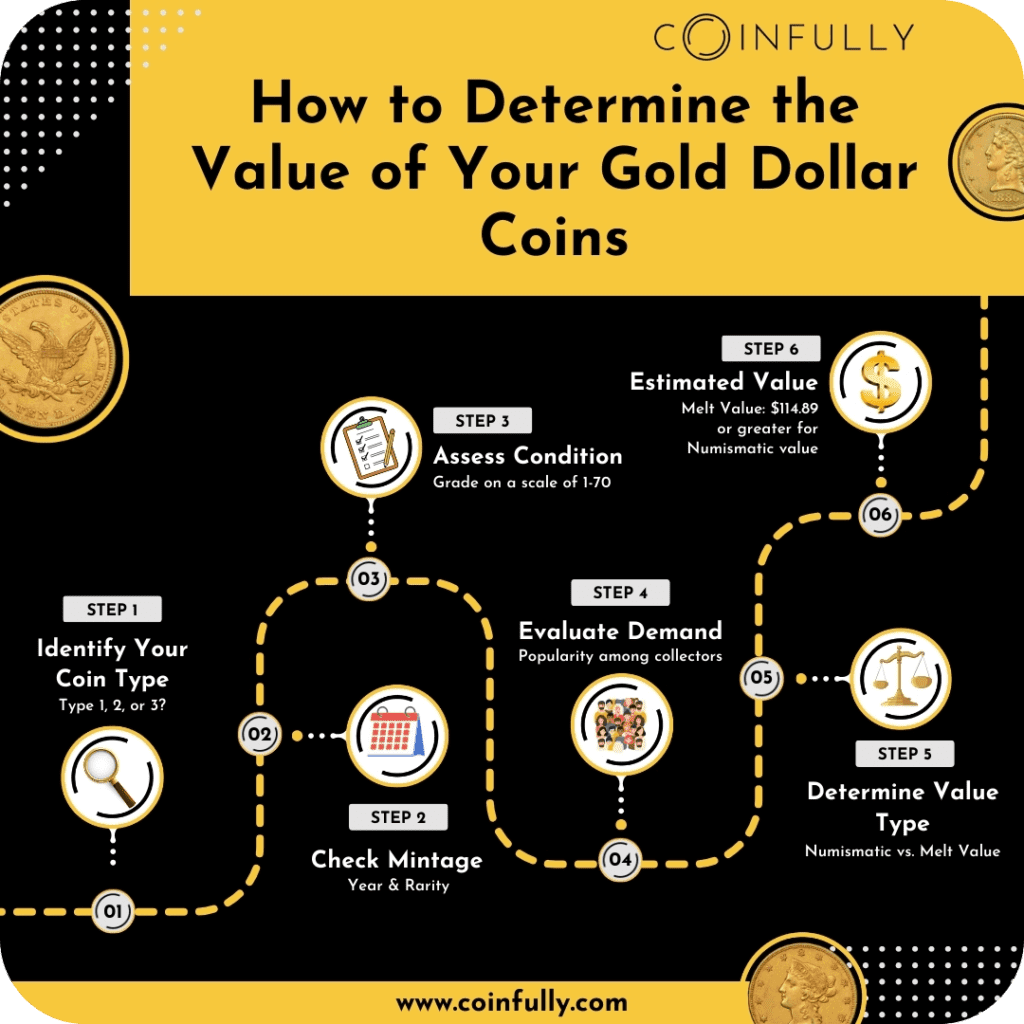

How To Determine the Value of Your Gold Dollar Coins

To accurately assess a gold dollar coin’s value, you must carefully examine its physical characteristics, design features, and overall condition, as each factor, from weight to mintmark, can significantly impact overall value.

Weigh and Measure Each Coin

Start by confirming the coin’s weight and diameter using a precise scale and calipers. Authentic 1849–1889 gold dollars weigh 1.672 grams and measure 13–15 millimeters, depending on type.

Variations can indicate counterfeits or worn coins, both of which affect melt value and collector desirability.

Note the Design and Date

Identifying the coin’s design type and minting year is essential. The three designs (Liberty Head Coronet, Indian Princess Small Head, and Indian Princess Large Head) have different rarity levels and market demand, with Type II being the least common.

Low-mintage issues are among the most valuable gold dollar coins, and collectors pay premiums for coins with well-preserved design details.

Check the Mintmark

Examine the coin for a mintmark, which, if present, is located on the reverse below the wreath. Coins lacking a mintmark were struck at the Philadelphia Mint.

Mintmarks can dramatically influence collector value due to low mintage or regional rarity, and comparing mintmarks against mintage figures helps determine scarcity.

- No mark = Philadelphia

- C = Charlotte

- D = Dahlonega

- O = New Orleans

- S = San Francisco

Access the Condition or Get a Professional Appraisal for Rare Coins

A coin’s condition can range from heavily circulated to pristine condition, directly affecting its market price.

If you’re familiar with coin grading standards, you can roughly judge the coin’s condition yourself; however, serious collectors rely on professional certifications from PCGS or NGC to verify authenticity and grade, which is something to consider if you are thinking of selling your coin collection.

If you’re not confident in your estimation of your coin’s value, a professional coin appraiser can provide an accurate evaluation, ensuring the coin’s numismatic and melt value are properly accounted for.

Modern “Gold” Dollar Coins

Modern “gold” dollar coins, such as the Sacagawea and Presidential dollar series, differ entirely from 1849–1889 gold dollars.

These coins are made of manganese-brass clad over a pure copper core rather than solid gold, giving them a gold-like appearance but minimal intrinsic value.

Intended primarily for circulation and collector programs, these coins carry nominal face value rather than bullion or significant numismatic value, although certain low-mintage or error coins can still be valuable to collectors.

Historic Gold Dollar Coins Worth Money

What gold dollar coins are worth money? For 1849–1889 issues, common circulated coins are generally worth melt value or slightly higher.

However, certain dates and mintmarks are exceptionally scarce, and well-preserved examples in higher grades are highly sought by collectors.

Coins with historical context, low mintage figures, or unique features can command significant value, sometimes reaching hundreds of thousands of dollars.

1849-C Liberty Coronet: $6,250–$690,000

The 1849-C Liberty Coronet is among the rarest U.S. gold dollars, struck at the Charlotte Mint, which had extremely limited production.

Its scarcity, combined with strong demand from collectors seeking coins representing early American history, makes it one of the most valuable rare coins in the gold dollar series. Condition dramatically affects its market price.

1852 Liberty Coronet: $168–$312,000

The 1852 Liberty Head Coronet was struck primarily at the Philadelphia Mint, though small quantities came from Charlotte and Dahlonega branch mints.

While most circulated coins are worth only slightly above melt value, high-grade Philadelphia strikes and the extremely rare branch-mint examples are highly prized by collectors. Value depends heavily on condition, strike quality, and survival rate.

1853 Liberty Coronet: $173–$264,000

The 1853 issue is notable for its combination of moderate mintage and surviving quality examples. Coins struck at branch mints, particularly with small numbers, are rare and valuable.

Coin enthusiasts prize examples with clean strikes and minimal wear, which contribute to higher values among collectors focused on early U.S. gold coinage.

1861-D Indian Princess Large Head: $40,011–$175,394

Struck at Dahlonega, the 1861-D Large Liberty Head is scarce due to the Civil War’s impact on mint operations.

Its historical significance and low surviving population make it highly desirable, particularly in pristine condition. Coins with strong detail and proper grading command premiums far above melt value.

1855-D Indian Princess Small Head: $20,444–$144,544

The 1855-D Liberty Indian coin is valued for its low mintage and branch-mint origin.

Collectors prize the sharpness of the Indian Princess design, which enhances numismatic value, while certified high-grade coins can reach significant value, particularly those that display exceptional eye appeal and minimal circulation wear.

1855-C Indian Princess Small Head: $3,400–$137,657

Struck at Charlotte, the 1855-C is rare due to extremely limited production. Its scarcity makes even modestly worn examples highly collectible, and coins with superior features or verified grading achieve higher values.

1865-D Indian Princess Large Head: $7,302–$112,184

The 1865-D Large Liberty Head is significant for both historical context and low surviving numbers from Dahlonega. Coins with sharp strikes, minimal circulation, and proper certification command strong prices.

Where To Get Valuable Gold Dollar Coins Appraised

If you suspect you have one or more valuable gold dollar coins in your collection and would like to know how to sell gold coins safely for the highest possible price, the first step is to get a professional appraisal to determine the true market value. You have several options for obtaining a professional appraisal:

- Local coin shops and numismatic dealers offer hands-on evaluations but can vary widely in expertise and fairness, so verifying credentials is essential.

- Auction houses provide expert grading and sales insights but may charge commission fees.

- Independent numismatic consultants or certified PCGS/NGC dealers deliver professional assessments aligned with current market data.

- Online appraisal services are quite convenient, but it’s imperative to choose platforms with transparent credentials, secure transactions, and a reputation for accuracy in numismatics.

- With Coinfully, you simply send us images of your collection, receive a detailed appraisal and competitive offer, and decide, with no pressure from us, whether to keep or sell your coins online.

Where To Sell Gold Dollar Coins

When it comes to deciding where to sell gold coins, you have a few options, with some safer than others.

Selling gold dollar coins successfully requires balancing convenience, price, and security. Each selling option has distinct advantages and drawbacks, so understanding how each works is key to maximizing your return.

Local Coin Shops and Dealers

Local coin shops and professional dealers offer in-store transactions and immediate payment. However, prices may be lower than market value since dealers must resell for profit. Always compare multiple offers and verify dealer credentials before proceeding.

Pawn Shops and Gold Buyers

Pawn shops and general gold buyers provide quick cash but typically pay only based on melt value, disregarding collectible or historical worth. These outlets are best for damaged or common pieces rather than rare or high-grade coins.

Auctions and Private Sales

Auction houses can yield strong results for rare coins, though listing fees and commissions reduce net proceeds. Private sales to knowledgeable collectors or investors may bring higher returns but require thorough documentation and caution to ensure authenticity and fair pricing.

Online Platforms

Reputable online marketplaces and coin-selling platforms reach a broader audience and can produce competitive offers. However, sellers must watch for scams, counterfeit buyers, and hidden fees.

Always use secure payment methods and platforms known for verified transactions and strong seller protections.

At Coinfully, our trusted, BBB-accredited process and experienced appraisal team ensure you always receive the best possible price with zero pressure to sell. To verify our commitment to surpassing your expectations, check out the ever-growing list of testimonials from past clients.

Coinfully: Free Appraisals and Competitive Offers for Gold Dollar Coins

At Coinfully, our mission is to make selling coins simple, transparent, and lucrative. We are an authorized dealer with PCGS and NGC, and our team includes numismatic legend Douglas Winter, as well as several other experts in the field.

Take advantage of our free online coin appraisals to get started. Simply upload photos or an inventory and receive a professional evaluation and market-leading offer.

If you decide to sell to us, your collection will be fully insured by Lloyd’s of London and verified under 4k cameras upon arrival. Payment will be issued within one business day.

For qualifying large or historically significant collections, we also offer an at-home appraisal service, where our numismatic experts travel to you, assess your coins, and provide a competitive offer and payment on the spot.

If security, transparency, and high returns matter to you, trust Coinfully for all your coin-selling needs. Whether you’re selling bullion, rare gold coins, valuable silver coins, or an entire coin collection, we’re here for you every step of the way.

Contact us today to speak with a numismatic expert and receive a top-of-market offer.

Learn More About Rare Coins Worth Money

Wyatt McDonald President & Co-Founder of Coinfully. A student of numismatics and trained in the ANA Seminar in Denver, Wyatt is the face of Coinfully and a true expert. After spending a decade buying coins over the counter at a coin shop, he knew there had to be a better way, for everyone involved.

Get an Appraisal

Think you’re onto something big with your collection? Let’s talk…

401 Hawthorne Ln, Ste 110-323 - Charlotte, NC 28204

401 Hawthorne Ln, Ste 110-323 - Charlotte, NC 28204