How To Sell Silver Coins and Silver Bullion for Top Price

Get Top Value When Selling Silver Coins

Dec 6th, 2025 · 7

How to sell silver coins? Start by identifying which pieces carry value beyond their silver content, and then research current prices, authenticate or grade valuable items, and gather multiple offers from trustworthy buyers. Choose a secure selling method, and protect yourself with insured shipping, written valuations, and clear documentation throughout the process.

Selling silver coins can be far more profitable, and far safer, when you understand what drives their value, how the market behaves, and which selling methods offer the strongest returns.

Whether you’ve inherited a collection or assembled one over time, knowing how to evaluate your coins and avoid risky buyers is essential.

If you would like to know the real value of your coin collection or are ready to sell silver coins online or in person, contact Coinfully today, and enjoy a free, comprehensive coin appraisal with no obligation to sell.

Table of Contents

What Are Silver Coins Worth?

Silver coins derive their value from a combination of factors, including their silver content, rarity, condition, and collector demand.

While most coins carry a face value, their silver value and numismatic value often significantly exceed face value, especially for fine silver or historically significant issues. Market fluctuations in the spot price of silver also directly influence what a coin may sell for.

Common Silver Coins Worth Money

Collectors and investors often seek out pre-1965 silver coins, which generally contain 90% silver and hold value above face value. Key U.S. coins include:

- Roosevelt Silver Dimes: 1946–1964 Roosevelt dimes are valued for silver content and condition.

- Mercury Silver Dimes: 1916–1945 Mercury dimes are priced for design and rarity in higher grades. Some rare dates carry numismatic premiums.

- Washington Silver Quarters: 1932–1964 Washington quarters are widely collected; some rare dates carry numismatic premiums.

- Walking Liberty Half Dollars: 1916–1947 Walking Liberty half dollars are notable for beauty and silver content. Some rare dates carry numismatic premiums.

- Franklin and Kennedy Half Dollars: 1948–1963 Franklin half dollars and 1964 Kennedy half dollars are valuable for silver and collector interest.

- Morgan and Peace Dollars: 1878–1921 Morgan silver dollars and 1921–1935 Peace silver dollars are sought after for rarity and collector value. Some rare dates carry numismatic premiums.

- American Silver Eagles: These modern bullion coins contain 1 troy ounce of .999 fine silver and are widely traded.

Factors That Determine Silver Coin Value

The value of a silver coin is influenced by both tangible characteristics and market forces that impact demand and desirability. Investors and collectors weigh aspects such as metal content, condition, rarity, and overall purity to assess a coin’s worth relative to the current market.

When learning how to sell gold coins and silver coins for the highest possible price, understanding their true value is fundamental.

Silver Content and Current Price of Silver

The intrinsic value of a coin begins with its silver content. Coins containing 90–99.9% fine silver derive a baseline value from the spot price of silver, measured in troy ounces.

Fluctuations in the silver price can quickly affect a coin’s melt value, making market timing important for those looking to maximize returns. Learn how to sell silver bullion for the best price to avoid leaving money on the table.

Coin Condition and Grade

A coin’s physical state directly impacts its collectible value. Scratches, tarnish, or wear reduce desirability, while well-preserved coins graded by professional numismatists often command higher premiums.

Coins that maintain luster and sharp detail not only fetch more but also demonstrate longevity for long-term collectors.

Date, Mintage Numbers, and Mintmarks

Certain years, low mintage quantities, and specific mintmarks can dramatically increase value. Scarcity drives collector demand, and even common coins from highly coveted years may achieve highest premiums.

Accurate knowledge of coins by type and their production history is essential when evaluating a collection.

Rarity

Rarity amplifies both intrinsic and collector value. A coin with limited availability or unusual errors may exceed the true market value of more common examples.

Numismatists and investors alike prize rare coins, making scarcity a key factor in deciding whether to sell and timing your sale strategically.

Collector Demand

The appeal to collectors, which is influenced by trends, historical significance, and aesthetic qualities, shapes the market value of a coin. Even coins with similar silver content can vary in price depending on demand.

Staying informed with market updates helps sellers gauge interest and identify the right buyer to achieve optimal returns.

How To Sell Silver Coins

How do you sell silver coins? Selling silver coins successfully requires careful preparation, research, and strategy to ensure you receive fair value.

By taking deliberate steps, from cataloging your collection to evaluating potential buyers, you can confidently navigate the market while protecting your investment in precious metals.

Organize and Inventory Your Coin Collection

Begin by categorizing coins by type, date, mintmark, and condition. Documenting the quantity of coins and noting any unique features or imperfections ensures accurate valuation.

A thorough inventory also makes it easier to compare offers from multiple buyers and provides a clear record if you plan to sell portions of your collection over time.

Check the Silver Market Price

Stay updated on the current spot price of silver, as this directly affects a coin’s baseline value. Monitor fluctuations in the current market to identify favorable selling windows.

Awareness of market trends allows you to maximize returns, especially for coins primarily valued for their metal content.

Determine Which Coins Are Worth More Than Melt Value

Not all silver coins are purely bullion. Some carry collectible or numismatic value that greatly exceeds their intrinsic silver content.

Evaluating each coin’s rarity, condition, and demand ensures you don’t sell items for just spot price and helps identify pieces that can fetch higher premiums from the right buyer.

Research Coin Price Guides and Market Value Trends

Consult trusted resources such as coin price guides, online databases, and American Numismatic Association publications to understand true market demand and recent selling prices.

Tracking market updates over time allows you to anticipate trends, avoid selling during temporary dips, and recognize when a coin may maximize its value.

Get a Professional Coin Appraisal

A certified appraisal provides an independent evaluation of the value of your coins and factors in condition, rarity, and market conditions.

Working with reputable dealers or professional numismatists ensures accurate pricing and can also increase buyer confidence when selling high-value or collectible coins.

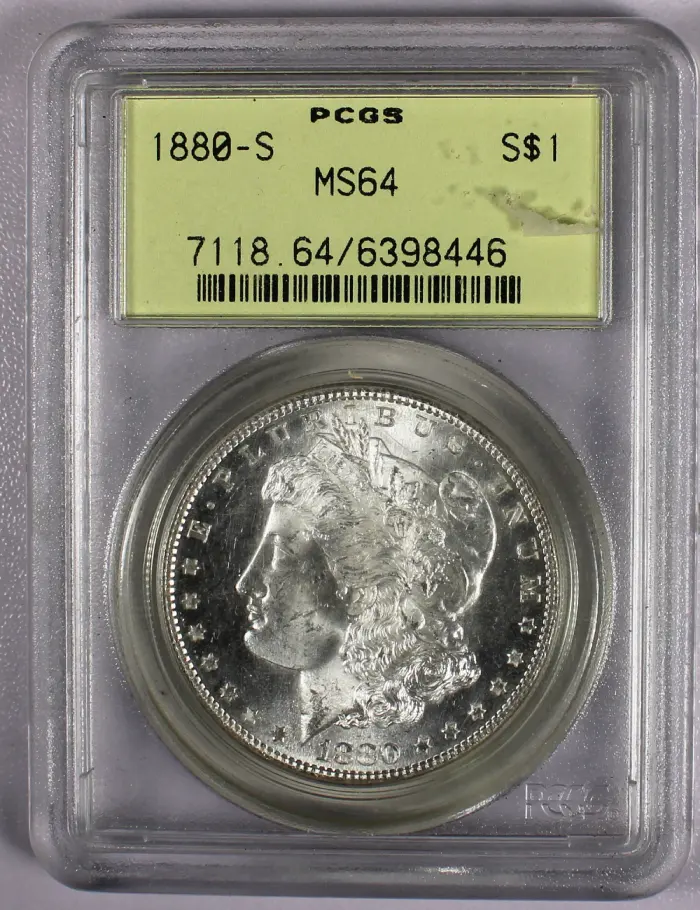

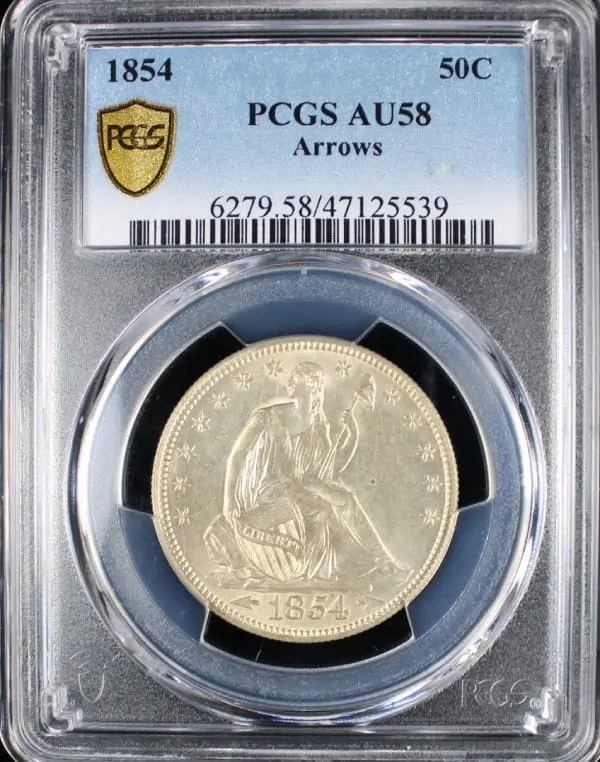

Have Rare Coins Graded

Grading by a recognized service, such as NGC, assigns a standardized condition score that can dramatically affect a coin’s market value.

Graded coins offer buyers assurance of authenticity and quality and often result in higher premiums and smoother transactions, particularly in online sales or auction houses.

Decide on a Selling Venue

Choosing the right platform is imperative to ensure safety and profit. Options include local dealers, auction houses, online marketplaces, or direct sales to private collectors.

Evaluate each venue for reputation, transparency, and the likelihood of connecting with the right buyer willing to pay fair market value.

Get Multiple Quotes

Soliciting multiple bids allows you to compare offers and gauge the true value of your collection. This step is especially important for rare or high-demand coins, as it helps ensure that you’re selling at a competitive rate rather than accepting the first offer received.

Ensure Safety and Secure Transactions

Prioritize secure methods for shipping or transferring coins, and confirm buyer legitimacy.

Using insured, trackable services protects against loss, while verifying credentials and reviews, such as Better Business Bureau ratings, helps establish good standing with reputable buyers and minimizes risk.

Where To Sell Silver Coins: Options and Associated Risks

Where can you sell silver coins? You actually have several choices of where to sell silver coins, though most are not ideal. Choosing the right selling venue can significantly impact the price you receive and the safety of your transaction.

Understanding the benefits and drawbacks of each option allows you to conduct proper due diligence and identify the best ways to maximize value while minimizing risk.

Sell Silver Coins to Local Coin Shops and Dealers

If you’ve been searching “sell silver coins near me,” several local businesses likely popped up in your search results.

While local shops offer convenience and immediate payment, estimated values and buying offers can vary widely between buyers. Without proper research, you can wind up accepting offers well below true market value.

Reputable dealers can provide fair pricing, but less scrupulous buyers may take advantage of your inexperience or urgency, so ensuring transparent practices and checking references is critical.

Sell Silver Coins at Coin Auctions

Auction houses provide access to competitive bidding and often fetch the highest premiums for rare coins. However, fees, commissions, and timing constraints can reduce net proceeds.

Prices can also fluctuate dramatically depending on bidder interest, making outcomes unpredictable. Sellers must understand auction rules and consider whether their coins are likely to attract the right audience.

Sell Silver Coins Online Through Marketplaces and Platforms

Digital platforms expand reach to collectors nationwide, but they also introduce risks of scams, misrepresentation, or non-payment. Sellers must verify buyers, use secure payment methods, and understand platform policies.

Prices may fluctuate quickly, and shipping risks must be mitigated with insurance and tracking to maintain a high standard of safety.

Sell Silver Coins Directly to Private Investors

Selling privately can offer flexibility and direct negotiation, but it demands careful vetting. Without established reputations, private buyers may offer less than market value or exploit sellers unfamiliar with coin grading and pricing.

Conducting careful research is essential to ensure transparency, fair offers, and a secure transaction with the right buyer.

Sell Silver Coins at Coin Shows

Coin shows provide opportunities to connect with multiple dealers and buyers in one location, which can allow you to compare offers easily. However, high-pressure sales tactics, variable pricing, and limited appraisal time pose risks.

Sellers should maintain awareness, know the best ways to evaluate offers, and approach each transaction ready to negotiate and protect their coins’ true value.

Best Place To Sell Silver Coins: Coinfully

Coinfully removes the uncertainty and stress that typically accompany selling silver coins by combining expert appraisal services with unmatched personal attention.

Instead of haggling with dealers who provide vague pricing, rushed evaluations, or risky shipping instructions, Coinfully gives you a clear, safe, and fully supported path from appraisal to payout.

Whether you prefer in-home service or online convenience, Coinfully is built around fairness, accuracy, and absolute confidence at every step, making Coinfully the best way to sell silver coins online hands down.

Free Online Coin Appraisals

Coinfully’s free online appraisals give sellers a fast, professional, and pressure-free way to understand exactly what their silver coins are worth.

Upload clear images and basic details, and one of our trained numismatists will conduct a careful evaluation based on condition, rarity, and current market performance.

You’ll receive a detailed, easy-to-understand valuation along with a firm offer, and you are never obligated to sell. Should you decide to sell to us, your shipment will be fully insured by Lloyd’s of London every step of the way.

If you have questions or want clarification, we are always happy to explain how your valuation was determined. Our goal is to empower you with knowledge so you can make the right selling decision.

Complementary At-Home Appraisals for Qualifying Collections

For qualifying collections, Coinfully offers something no other coin buyer provides: a concierge in-home appraisal service. One of our professional appraisers will travel directly to your home, or a location of your choosing, to evaluate your silver coins in person.

This eliminates the anxiety of transporting valuable items or hoping a high-value shipment arrives safely. During the visit, our expert will walk you through each coin, explain the valuation process, and discuss an offer with total clarity.

If you decide to sell, we’ll complete payment on the spot. If not, you walk away with a fully informed understanding of your collection’s value, with no pressure and no fees.

Full Transparency, Insured Shipping, and Fast, Secure Payouts

If you choose to mail in your coins, Coinfully provides fully insured shipping, giving you complete peace of mind. Every package is recorded under high-resolution security cameras as it is opened and verified.

Once authentication is complete, payment is issued immediately by check or electronic transfer, whichever you prefer.

From the first message to the final payout, Coinfully maintains a level of transparency, communication, and professionalism that sets a new standard for selling silver coins.

Tips for Protecting Yourself From Scams and Fraud When Selling Silver Coins

Selling silver coins requires caution, especially when dealing with unfamiliar buyers or online platforms. Taking a few protective steps ensures your coins, and your money, remain secure throughout the process.

Follow these expert tips:

- Verify dealer credentials, licensing, and online reviews before engaging.

- Avoid buyers who refuse to provide written offers or valuation details.

- Never ship coins without insured, trackable packaging.

- Request documentation that outlines how your coins will be authenticated.

- Be wary of overly high, fast-expiring offers that pressure you to act.

Common Mistakes To Avoid When Selling Silver Coins

Even experienced collectors can lose money or put their valuables at risk when selling silver coins without proper preparation. Knowing the most frequent mistakes helps you avoid costly missteps and protect your return.

Common mistakes include:

- Selling coins for melt value without checking for rare dates or collectible premiums.

- Accepting the first offer without comparing reputable buyers.

- Failing to research a dealer’s reputation and business history.

- Shipping valuable coins without insurance or tracking.

- Cleaning coins in an attempt to improve appearance (which lowers value).

- Overlooking fees or commissions associated with certain selling venues.

- Selling during short-term dips in silver market performance.

Determining the Best Time To Sell Your Silver Coins

The ideal time to sell depends on market strength, silver price trends, and your personal financial goals. Monitor long-term price charts, investor demand, and economic conditions to identify favorable windows.

When silver performs strongly or demand for historic U.S. coins rises, sellers often secure better offers. Evaluating recent market activity, auction results, and professional guidance can help pinpoint an optimal moment to sell.

Get a Better Price for Silver Coins With Coinfully

Selling silver coins successfully comes down to accurate valuation, safe transactions, and choosing a buyer who puts your interests first. Coinfully delivers all three.

With expert appraisals, concierge-level service, and a fully transparent process, you always know exactly how your coins are evaluated and what they’re worth.

Whether you prefer free online appraisals or at-home evaluations for qualifying collections, Coinfully consistently provides strong, fair offers and a secure, streamlined experience. When you’re ready to sell, Coinfully is the clear choice for maximizing your return.

Contact us today to learn how much your silver coins are actually worth and receive a competitive offer. Whether you wish to sell junk silver coins, sell silver proof coins, or sell an entire coin collection, we’re here to help you every step of the way.

Frequently Asked Questions About How To Sell Silver Coins

Are silver coins worth selling?

Yes, silver coins can be worth far more than their face value, especially if they contain high silver content, are pre-1965, or have collectible appeal. Coins with rare dates, low mintage, or excellent condition can command significant premiums from collectors and investors alike.

Is it a good time to sell silver coins?

Timing depends on market trends and silver prices. When silver is strong or demand for collectible coins rises, sellers can achieve higher returns. Monitoring market updates and coin-specific demand helps you determine if current conditions are favorable for selling your silver coins.

How much can I sell a silver coin for?

The value of a silver coin varies based on silver content, rarity, condition, and collector demand. Common coins may fetch melt value, while rare or high-grade pieces can command substantial premiums. Accurate appraisals and market research ensure you get a fair price for each coin.

Can you cash in silver coins at the bank?

Banks typically only accept silver coins at their face value, which is often far below their actual silver or collectible value. To get full value, it’s better to sell to reputable dealers, collectors, or specialized services that consider both metal content and numismatic value.

Learn More About Selling Coins

Wyatt McDonald President & Co-Founder of Coinfully. A student of numismatics and trained in the ANA Seminar in Denver, Wyatt is the face of Coinfully and a true expert. After spending a decade buying coins over the counter at a coin shop, he knew there had to be a better way, for everyone involved.

Get an Appraisal

Think you’re onto something big with your collection? Let’s talk…

401 Hawthorne Ln, Ste 110-323 - Charlotte, NC 28204

401 Hawthorne Ln, Ste 110-323 - Charlotte, NC 28204